GM Shows Its EV Future – 10 Models, Entry to Exotic, Should Tesla Worry?

[March 11, 2020]

For years, GM has talked up its commitment to electrification, and said, “Big things are coming.” This last week, the company finally put its money where its mouth is and showed 10 prototypes of upcoming production models. More importantly than the “proof of concept” technology showcase was the breadth of models paraded by the company, ranging from C-Segment and entry crossovers, all the way up to full size trucks and luxury sedans. In the spirit of full disclosure, I did not see any of the models firsthand, but since cameras were prohibited at the event anyway, I couldn’t have brought you photos if I wanted.

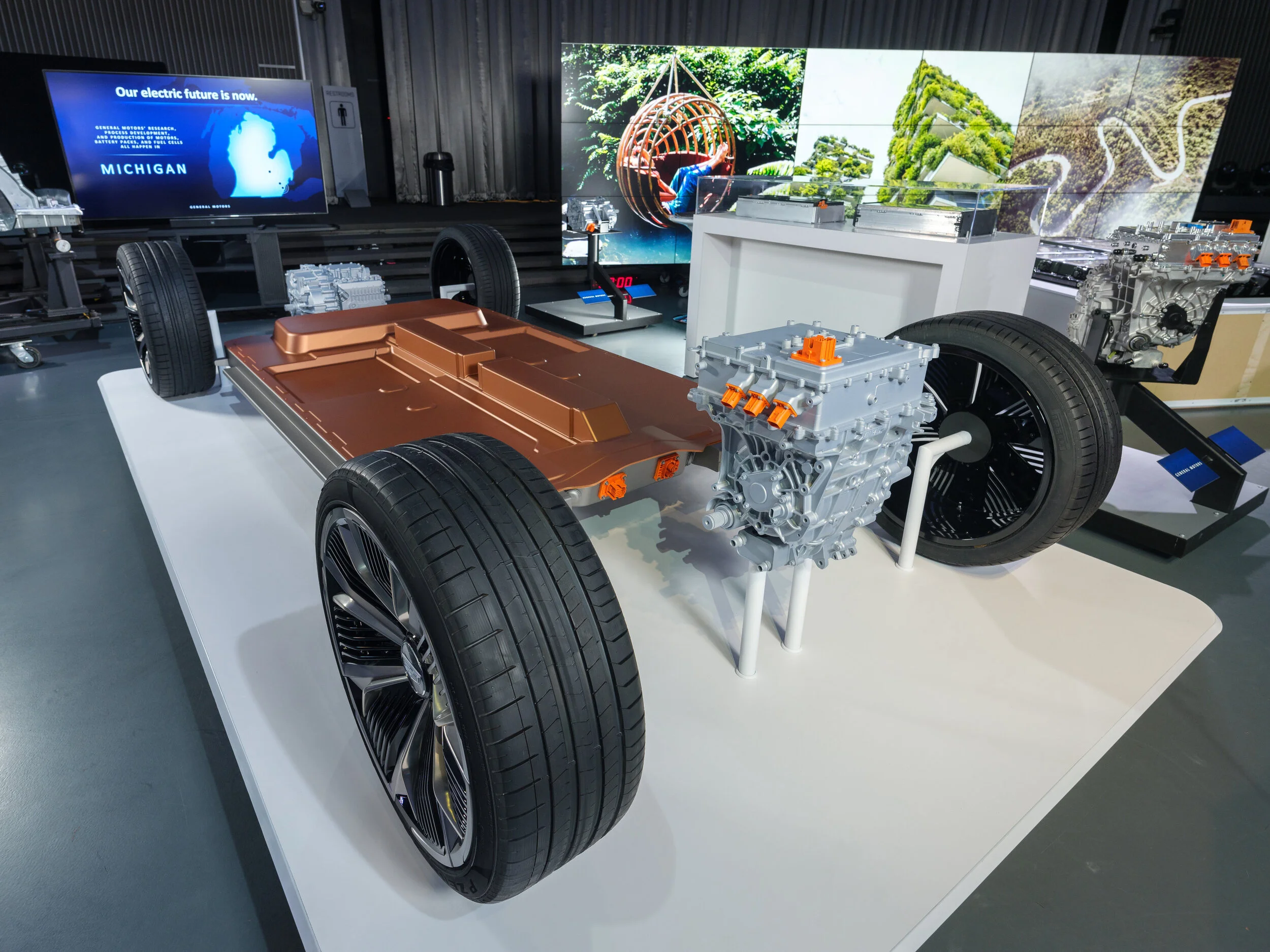

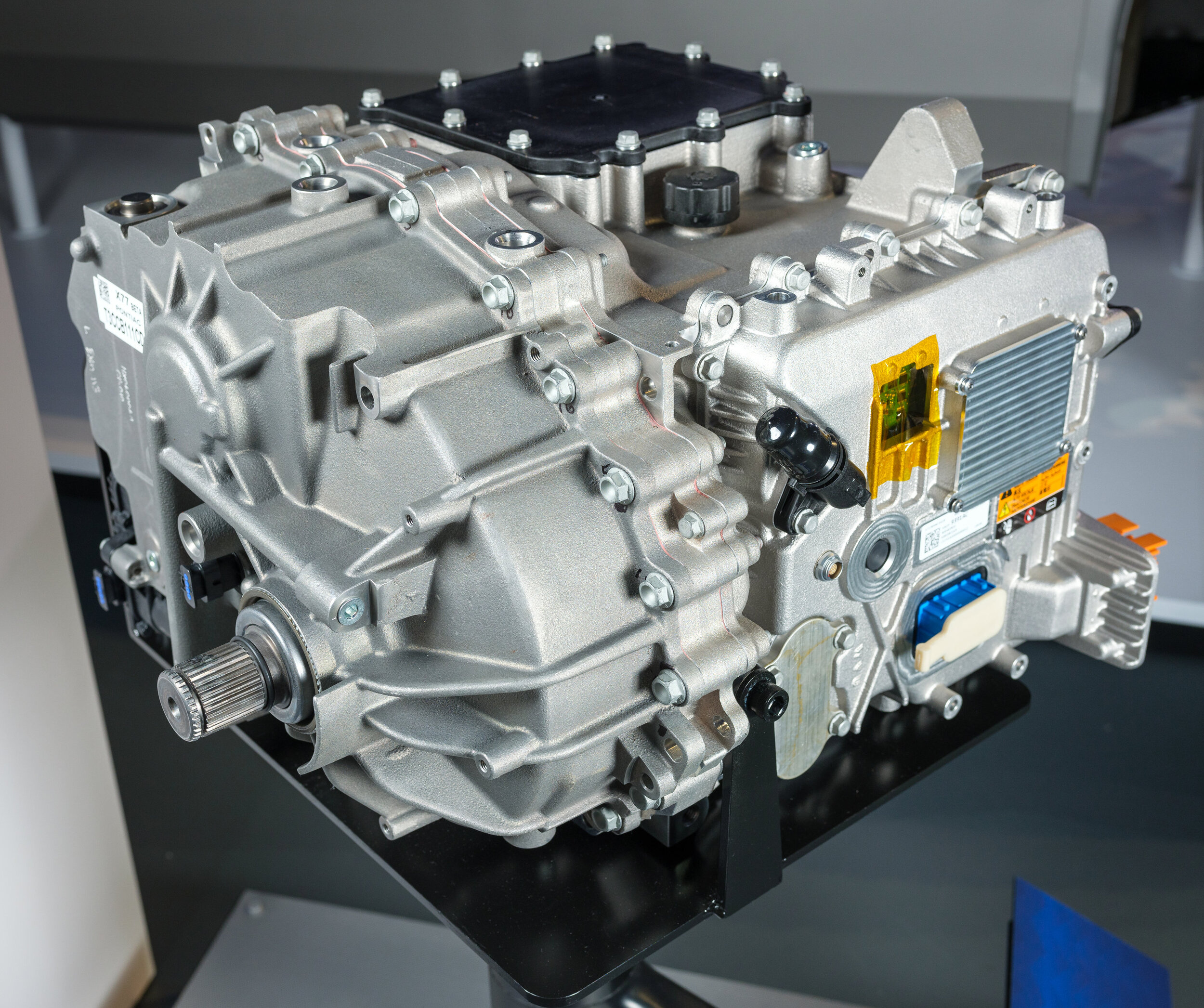

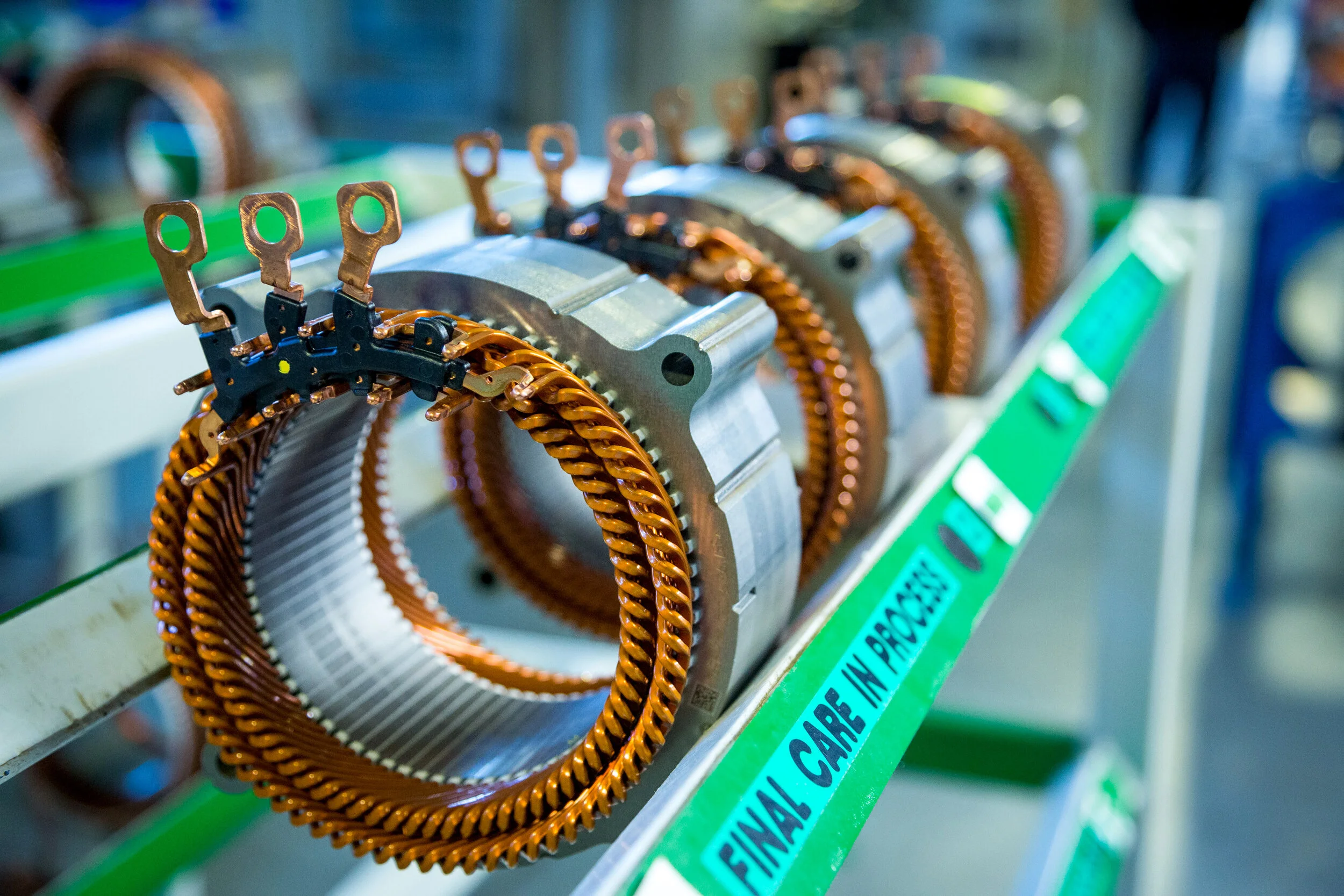

At the heart of GM’s EV initiative is its “Ultium” battery technology, a modular platform designed to accommodate battery packs from 50 kWh to 200 kWh. The cells are designed to be configured vertically or horizontally, offering a multitude of packaging options for varying vehicle configurations.

As has been expected for a while, the first production model expected to employ the technology is Cadillac’s mid-size crossover, which now has a name Lyriq. Other variations utilizing the Ultium platform range from compact crossovers from Buick and Chevrolet, and electrified trucks and SUVs from Chevrolet and GMC. An EV Escalade is also in the works. But the crown jewel of the show was the Cadillac Celestiq. The fastback sedan was described by most as similar to a Porsche Panamera (or conversely, a Tesla Model S), featuring a full-width display on the dashboard, as well as a rear-seat display.

Unlike past EV initiatives within GM and elsewhere that bled hundreds of millions of dollars and were ultimately abandoned, GM President Mark Reuss said the Ultium platform is structured to be profitable from an early stage. Certainly, the platform’s modular concept, in which the R&D costs can be spread over multiple models and brands, helps in that regard. The fact that GM is planning multiple models, rather than just one “halo” car, is a further demonstration of the company’s commitment to electrification.

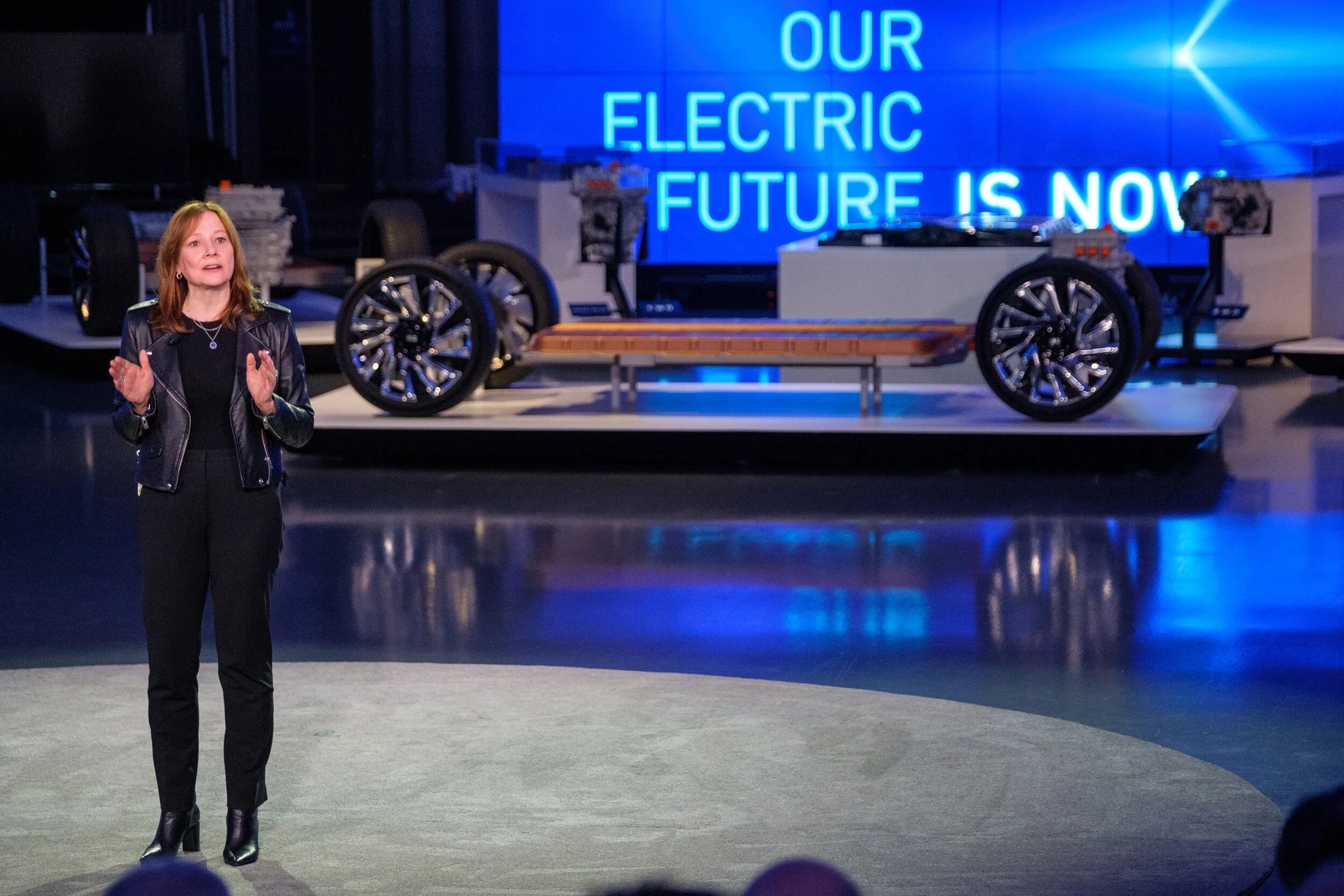

(GM’s March 4, 2020, EV Day showcased the company’s forthcoming EV technology and platforms.)

The one area where GM remains tentative and non-committal is charging infrastructure. GM executives have repeatedly said, “We don’t want to be in the charging infrastructure business.” This could either be seen as a shrewd pragmatic business decision, or a critical oversight that could hamper EV adoption efforts. The company did say it will require some of its dealerships to install Level 2 and Level 3 chargers on-site, and would assist new buyers with home charger installation.

Charging infrastructure is the one area where Tesla continues to distinguish itself from competitors, partly out of necessity, since it adopted a proprietary plug standard that requires an adapter to use J1772, and generally cannot be used with CCS Level 3 chargers. Other than Volkswagen and its associated brands (Audi, Porsche, etc.) with Electrify America, few others have shown this level of commitment. Even Ford, with its claimed commitment to EV infrastructure build-out, is largely structured around partnerships.

Certainly, with its multi-vehicle strategy, GM is stepping up its EV product initiative unlike many others in the industry, which are only committing to a few token models to meet regulatory requirements. With its vast network of franchised dealerships from coast-to-coast, broad name recognition, and decades of brand loyalty for some of its brands, it seems poised to have as good a chance as anyone to being a legitimate competitor to Tesla in terms of EV sales volumes.

But success is not guaranteed, and even with its massive multi-billion-dollar investment in its multi-model electrification push, there’s still a chance customers could shun the company’s EVs in favor of ICE models. A lot of that will have to do with the dealers. And frankly, I’m still skeptical. Dealers have a vested interest in selling and servicing internal-combustion engine vehicles. EVs require a fraction of the maintenance of conventional cars, and in some cases, dealers get more than 50% of their revenue and profits from service operations. Do you think they’re going to consciously starve themselves of future revenue to feel all warm and fuzzy right now? We shall see how GM’s ambitious EV strategy plays out.

(Images courtesy General Motors)

Like what you read?

Follow us on Google News and like us on Facebook!